•Huge cash in circulation causing naira depreciation, says IMF

The Nigeria National Petroleum Corporation Limited and the Ministry of Finance have agreed to remit all their dollar revenues to the Central Bank of Nigeria, CBN, to boost the nation’s External Reserves and foreign exchange flows into the country.

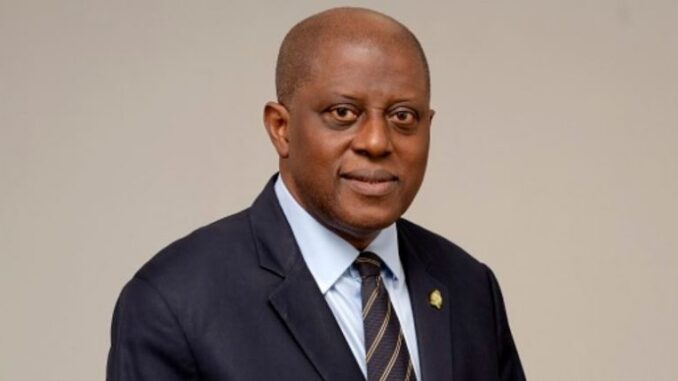

The apex bank’s governor, Olayemi Cardoso, disclosed this during his keynote speech at the launching of the Nigerian Economic Summit Group macroeconomic outlook report for 2024 on Wednesday.

He declared, “I am pleased to note our collaboration with the ministry of finance and the NNPCL to ensure that all FX inflows are returned to the CBN. This coordinated effort will enhance the bank’s FX inflows and contribute to the growth of reserves.”

The governor, who was speaking on the efforts of the bank to address FX challenges in the country, noted that stability is expected in the foreign exchange market in 2024 due to a combination of factors.

Cardoso stated, “The expected stability in the FX market for 2024 can be attributed to the reduction in petroleum product import and the recent implementation of the market-determined exchange policy by the CBN. This reform is designed to streamline and reform multiple exchange rates.

“The resulting consistent and stable exchange rate will not only boost investors’ confidence but also attract foreign investment alleviating Nigeria’s appeal to global investors.”

According to the governor, the CBN is currently implementing a comprehensive strategy to improve FX liquidity in the short, medium, and long-term.

He said the naira was currently undervalued and with coordinated measures from both the fiscal and monetary side, it would experience genuine price discovery in the near term.

He re-echoed that the bank was clearing its backlog of FX transactions.

He said, “In our efforts to stabilise the exchange rate, we must prioritise transparency and create a market environment that creates a fair determination of exchange rates ensuring stability for businesses and individuals alike.”

Recently, the World Bank disclosed at the launch of its Nigeria Development Update, December 2023 edition titled, ‘Turning The Corner (from reforms and renewed hope, to results)’ that the NNPCL has not been transparent about dollar revenue especially financial gains from fuel subsidy removal.

The global bank stated, “Except for the exchange rate-related increases, however, there is a lack of transparency regarding oil revenues, especially the financial gains of the Nigeria National Petroleum Corporation from the subsidy removal, the subsidy arrears that are still being deducted, and the impact of this on Federation revenues.”

Also speaking at the event, the Minister of Finance and Coordinating Minister of Economy, Wale Edun, stated that the government was ready to scrutinise revenue flow from NNPCL.

Fuel price fall

During his keynote speech on Wednesday, Cardoso revealed that there are expectations that the pump prices of fuel will fall this year because of the anticipated operations of local refineries in the country.

The apex bank governor said, “The anticipated moderation in pump prices of PMS due to the expected operational state of the country’s three government’s refineries and private owned refineries in 2024 is a pivotal factor in the economic situation.

“The economic stabilisation or reduction in fuel cost is poised to have far-reaching implications across various sectors contributing significantly to overall economic efficiency and resilience.”

The governor in his comments on inflation revealed that the bank hopes to tame inflation, that is currently at 28.92 per cent as of the end of December 2023, to 21.4 per cent in 2024.

He explained, “Inflationary pressures are expected to decline in 2024 due to the CBN inflation targeting policy which aims to rein in inflation to 21.4 per cent. This will be aided by improved agricultural productivity and the easing of global supply chain pressures benefitting businesses by boosting consumer confidence and purchasing power.”

He noted that the CBN’s adoption of inflation targeting framework involves clear communication, use of monetary policy instruments, and collaboration with fiscal authorities to achieve price stability.

He added, “The outlook for decreasing inflation in 2024 will have a profound impact on businesses providing a more predictable cost environment and potentially leading to lower policy rates, stimulating investment, fueling growth, and creating job opportunities.

“Additionally, the bank has reverted to the conventional monetary policy approach with a focus on attaining price stability which fosters sustainable economic growth for Nigeria.”

Cardoso, who is making his first public comments on the economy in 2024, stated that the country hopes to grow its economy by 3.76 per cent in 2024, which is underpinned by the implementation of key government reforms.

He commented, “Foremost among the factors contributing to this positive outlook is the expectation of improved crude oil prices and production, highlighting the crucial role the oil industry is expected to play in driving economic growth.”

He highlighted the anticipated positive outlook for industry, services, agriculture, mining, electricity, gas, and water supply sub-sectors.

In his concluding remarks, Cardoso stated that the economy was at a point of stabilisation. In a pitch to investors, the CBN governor said, “Investors, both local and foreign, as well as other stakeholders, can rest assured that the economy will transition to a new state of stability in the short to medium term as we recalibrate our policy tool kit and implement far-reaching measures.”

Also speaking on exchange rates during a panel discussion at the event, Nigeria’s Country Representative, International Monetary Fund, Dr. Christian Ebeke, linked the country’s exchange rate volatility to excess naira in circulation. He also stressed the need for the country to reduce its inflation rate.

He said, “This is because if you look at naira pressures, you can decompose them into three main categories. One is the fact that you have excess naira in the market. The second one is structural; the market is new. These reforms are bold, the government needed a lot of courage to let the naira depreciate like that in a country where the naira has been quite stable for a while.

“The market is still new. It is still in its price discovery mode. Market participants are still learning how to transact in an orderly fashion. These structural factors affect the naira because the market is new, it is a little bit shallow is also responsible for volatility in the market.

“Then, there is also uncertainty in the market. I am not sure that the parallel rate is the ultimate rate. At some point, we may think about a fair naira rate that is probably between what we see in the parallel market and the official market. But it is very difficult while you are still in the transition phase to talk about what is a fair value and what we are seeing.”

According to Ebeke, transparency is important in the FX market especially now that the CBN is embarking on inflation targeting. He noted that if the government can tighten policies and manage to address the FX supply issues, generating FX through export growth, oil exports, and FPI inflows, the naira will converge to a fair value.

He stressed that the focus should only be on cutting expenditures but also on raising revenues so that the country can stabilise its debt level and address urgent development needs.

He added when he was asked about the recent call by BDCs to be allowed to publish their rates, “This call by BDCs to publish rates is up to the administration to see if it makes sense to them. But ultimately, transparency makes sure that everyone understands what is going on.”

Recently, the CBN revealed that the number of naira in circulation increased from N1tn as of February 2023, to N3.4tn as of December 11, 2023.

On his part Nigeria’s Lead Economist, World Bank Group, Dr Alex Sienaert, noted that the government needed to focus on bringing down inflation which would bring about price stability and support the value of the naira.

He said, “The key risk to manage is that the exchange rate is the price of the naira relative to other currencies and the prices in this economy are increasing very quickly. The inflation story that we have also focused on. So, it is natural that the relative value of the naira is also coming under pressure. This is exacerbated by a situation where globally we have tight dollar liquidity.

“To safeguard the benefits of this major currency adjustment and move to a new flexible system, I think the key thing is for the Central Bank as the critical agent but also other stakeholders to be laser-focused on inflation and bring about price stability which will support the value of the naira.”

NESG and GDP

The Nigerian Economic Summit Group has predicted that the Nigerian economy will grow at 3.50 per cent in 2024. In its 2024 outlook titled, ‘Economic Transformation Roadmap: Medium Term Policy Priorities.’

It also expected inflation rate to fall to 21.5 per cent in 2023. Its GDP growth projection is less than the Federal Government’s 3.75 per cent, the World Bank’s 3.1 per cent, and the IMF’s 2.90 per cent.

It said, “The outlook for 2024 is intricately shaped by a myriad of external and domestic factors, reflecting the dynamic nature of both local and global economic terrains.”

It continued, “Real GDP growth is expected to rise rapidly to 3.50 per cent in 2024. Various reform programmes initiated by the government are expected to trigger an uptick in economic growth as strains on investment are addressed, and low productivity in critical sectors is resolved.

“The services sector will remain the economy’s key driver, while the anticipated rebound of the country’s Oil sector will push stronger real GDP growth in 2024.”

Be the first to comment