deliberate plans to beat inflation. Although the Central Bank of Nigeria (CBN) was expected to safeguard returns for investors by keeping inflation low, that expectation was dashed after it consistently missed six to nine per cent inflation target for eight years. Savvy investors are now divesting to dollar assets with returns above 50 per cent to beat double-digit inflation rate. With naira losing over 40 per cent of its value in parallel market and inflation hitting 28.2 per cent in November- 11th straight month surge to the highest level in 18 years- investors see divestment to dollar assets as the sure route to hedge against inflation and protect their capital against value erosion. As more investors dump nairaassets-equities, savings for dollar funds, Assistant Business Editor COLLINS NWEZE warns of the grave danger the emerging trend portends for exchange rate stability and overall economic development.

Michael Nwadike, a Lagos-based entrepreneur was passionate about keeping his funds in savings accounts.

For him, a savings account is an effective way to store money in a secure location where it can earn interest. With a savings account, he can maintain his savings in a liquid state — meaning he can access the funds whenever he wants. But the low interest on savings accounts remains a setback for him.

Nwadike is now looking beyond the liquidity of his assets to having a bountiful returns that will cover the surging inflation rate, now 28.2 per cent in November- 11th straight month of spike and highest level in 18 years.

He narrated how, despite depositing N50 million in a savings account with a commercial bank, he was paid seven per cent interest, which is 21.2 per cent below the 28.2 per cent inflation rate.

In practical terms, the inflation rate means that the prices of goods and services increased by 28.2 per cent between November 2022 and November 2023. That means a bag of onions that cost N100,000 in November 2022 increased by N28,200 in November 2023 to cost N128,200.

Findings showed that when the demand for goods and services outweighs the supply, buyers become willing to pay higher prices. Also, when there is increase in supply of money, without a corresponding increase in output or productivity in the an economy, it will lead to rise in prices.

As inflation rises, millions of Nigerians that invested in low yield or zero interest funds got poorer and may not be able to meet their daily obligations because their funds are gradually losing value.

For instance, Nwadike’s interest rate on his savings deposit could hardly cover N1 million rent for a three-bedroom duplex he rented in the Ajah axis in Lagos.

“I have been keeping my funds in the savings account for decades because of easy access to the funds. But the interest earned on the funds cannot even beat the rate of inflation. The reality has dawn on me that there could be alternative investment plan to guarantee my wealth and provide better returns,” he narrated.

But savvy investors have seen the devastating impact of inflation on their investments and are changing their investment strategy.

Stevens Ben-Okoafor, a Nigerian resident in Holland, is one of the investors that have, for decades, prioritised diversified investment plan. He knows the dangers of putting one’s eggs in one basket, which is one of the first lessons investment managers teach greenhorns.

But in January this year, he took an unusual but decisive decision to elevate his returns on investment. Ben-Okoafor instructed his banks to liquidate his naira investments – savings and fixed deposits – and convert the proceeds to dollars. His investments in equities were also liquidated with the proceeds converted to dollars.

Ben-Okoafor had monitored with enthusiasm, the 35 per cent return on investment recorded by dollar funds in 2022, and decided to explore that opportunity.

“I noticed that many investors were scrambling for dollar assets, which returned average of 35 per cent in 2022, as against six to eight per cent average returns on savings. Not wanting to be left behind of this year’s largesse, I decided to put all my eggs in one basket: dollar assets,” he said.

Return on dollar assets rose to an average of 50 per cent in November, 21.8 per cent premium above 28.2 per cent inflation rate.

Although most dollar funds paid 10 per cent interest on investment, but capital appreciation due to over 40 per cent depreciation of the naira at both official and parallel markets marked up the overall returns to 50 per cent.

The naira exchanges at N1,220/$ at the parallel market and N880/$ at the official market, creating a premium of N340/$. The naira depreciation has been linked to persistent dollar scarcity and rising demand for the dollar.

Findings showed that even the sterling performance of Nigerian equities, which netted N12.4 trillion capital gains, and an average 44 per cent year-to-date returns could not match the yields on dollar assets.

Akpan Okon, an investor in the Nigerian equities, said although his investment returns did not match those of dollar funds, but he was better off than those that kept their funds in savings.

He said: “I know that dollar funds beat my investments, but I am better off than those that placed their funds in savings account, and absorbed larger part of the inflation heat. Still, there are pockets of value in the equity market, which are worth exploiting, and there are number of listed companies whose long-term internal returns on equity (RoE) suggest positive long-term total returns,” he stated.

Dollar assets gain momentum

More investors joined the dollar assets race after the Central Bank of Nigeria (CBN) librarised dollar investments with a new foreign exchange policy that allows investors to transfer dollar cash deposits from their domiciliary account to other domiciliary accounts The daily limit was pegged at $10,000.

Before now, dollar-based investments can only be done by people with dollar inflows, thereby shutting the doors against people not earning dollars from offshore.

Already, Afrinvest Asset Management Limited introduced an open-ended mutual dollar fund which pays about 10 per cent interest per annum. The fund provides a significantly higher return compared to funds kept in a domiciliary account in Nigeria or current bank account in Europe or America.

The Afrinvest Dollar Fund was created to help investors achieve income generation, capital preservation and portfolio diversification in the short to medium term. It was designed to deliver significantly higher returns and dividend will be paid twice a year. Nigerians will be able to invest in the fund with as little as $1,000.

Stanbic IBTC Dollar Fund was equally inaugurated by Stanbic IBTC Asset Management to provide currency diversification, income generation and stable growth in US Dollar. In emailed note to investors, the investment company said it will be investing a minimum of 70 per cent of the portfolio in high quality Eurobonds, maximum of 25 per cent in short term US Dollar deposits and a maximum of 10 per cent in US Dollar equities approved and registered by the Securities and Exchange Commission of Nigeria.

Its fund manager advised that investors are expected to transfer the investment amount not less than $1,000 for the first investment and not less than $500 for subsequent top ups, using he bank app or by visiting the bank branch to initiate the transfer.

“When you fund your investment, you can earn extra money by referring friends and family. You can also add to your investment over time and withdraw at your convenience. If you have questions or need assistance, please reach out. We are here to help you get started,” the company said.

It also promised competitive returns in dollars, controlled risks and easy access to funds via its Super Apps.

Investors, it reiterated that investors can also hedge against inflation by earning in dollars adding that the new forex guidelines permits them to transfer dollar cash deposits from their domiciliary account to other domiciliary accounts with a daily limit of $10,000.

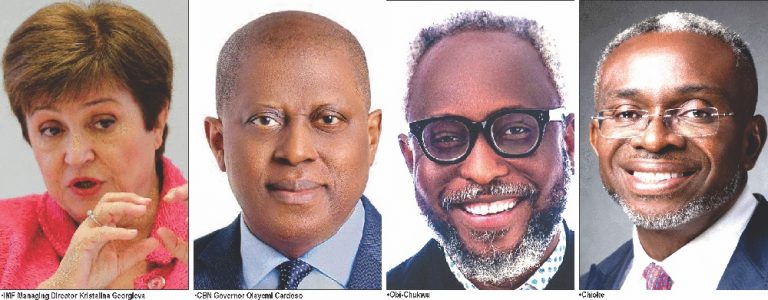

An investment analyst/Chief Executive Officer, Nairametrics, Ugochukwu Obi-Chukwu explained that dollarisation happens because people are afraid, that inflation will keep eating up their naira.

He said that people forget that as they keep buying dollars, the exchange rate will be depreciating.

“There is a sense of hurry, that the government also has. Even government dollarises. When they privatise assets, the assets are sold in dollars. Even at the sea ports, the fees you pay are converted in dollars, as well. Government machinery itself is essentially dollarised and other segments of the economy follow,” he said.

“They only way to solve dollarisation, is to have a stable exchange rate. People need to have confidence in their local currency, which means that inflation also needs to reduce. You need to restore confidence in your local currency, otherwise, people will dollars their assets. People will only hold the currency that will guarantee their survival,” he stated.

Group Managing Director, C & I Leasing Plc, Ugoji Lenin Ugoji said the CBN remains at the best position to advise government on the steps to take to overcome ongoing forex crisis. He however, advised businesses and investors to plan their forex transactions wisely.

Speaking during a virtual presentation of the company’s facts behind the third quarter 2023 figures, he advocated dollar earnings by individuals and companies in this period of economic and exchange rate volatility.

What other stakeholders are saying

During investors forum in Lagos, Chief Investment Officer, Afrinvest Asset Management Limited, Robert Omotunde, said “It makes sense to take advantage of dollar investment opportunities for investors with dollar inflows. There are portfolios or opportunities that you can take in different asset classes. There is no over-emphasising the point that investors that are going to beat inflation, and get superlative return, need to consider diversification by currency, and United States dollar is a major currency diversification that we preach,” he said.

Head of Research at Coronation Asset Management Limited, Guy Czartoryski, disclosed that review of deposits in top 10 banks showed that 40 per cent of customers’ total savings, current and term deposits accounts are in dollars.

He said high net-worth Nigerians now prefer to save their cash in dollars. “Many investment banks had floated dollar funds, giving depositors and savers opportunity to hedge against naira depreciation. High net-worth customers of banks now prefer to save their funds in dollars, with dollar deposits now 40 per cent of total banking sector deposits,” he stated.

He said the financial sector has also seen a rise in the number of customers liquidating their savings deposits, and moving the funds to Mutual Funds, where interest are now higher and risks lower.

The Chief Business Officer, Optimus Investment, Ayodeji Ebo, highlighted the dangers of keeping idle funds. While encouraging more people to invest instead of keeping idle funds, Ebo noted the reality of inflation spike is that it reduces purchasing power of the people.

“Even if interest or the return you are getting on your investment is below inflation rate, doing nothing will make you worse off. By investing in equities, money market, treasury bills or dollar funds, you are likely to reduce the impact of inflation on your funds,” he stated.

Ebo explained that although inflation is running far ahead of returns, that should not deter investors’ commitment. “Assuming you earn between 10 to 20 per cent returns, it means you have been able to cut down your actual cost of living by at least 10 per cent. In real terms, your exposure to inflation is moderated by the extra income from investing, which is better than just taking inflation 100 per cent,” he added.

He said: “The options available are equity investment, treasury bills/commercial papers, federal government bonds/corporate bonds, federal government savings bond and dollar funds. Equity investment is the buying and selling of stocks listed on the Nigerian Exchange and NASD OTC market. Treasury bills are issued by the Central Bank of Nigeria (CBN) on behalf of the federal government; commercial papers are issued by corporate bodies to meet short term obligations. The federal government of Nigeria bonds/corporate bonds are issued by the federal government and corporate bodies, respectively, to meet capital projects,” he explained.

Treasury Bills, FGN Bonds bullish

Market indicators showed that the Nigerian Treasury Bills (NT-Bills) secondary market has sustained bullish run for weeks.

Last week, the average NT-Bills yield declined 272 basis points Week-On-Week (bps W-o-W) to settle at 8.29 per cent from 11.01 per cent the previous week.

The bullish sentiment recorded in the secondary market was driven by a race to fill unmet bids at the Primary Market Auction (PMA) which caused a post-auction surge.

Managing Director, Afrinvest West Africa Limited, Ike Chioke, said buy interest was witnessed across all maturities as average yields declined by 200bps, 238bps and 307bps at the short, mid, and long ends respectively. In specific terms, the instruments which witnessed the most buy interest and propelled the market to a positive close were the 11-July-24 (615bps), 12-September-24 (452bps) and 26-September -24 (411bps).

At the PMA held on December 13, the CBN offered a total of N13.58 billion across the 91-, 182- and 364-Day instruments. The offer maintained a significant level of demand as the bid-to-cover ratio printed at 39.6 times, 39.2 times and 132 times respectively. Consequently, the stop rates on 91- , 182 – and 364-Day instruments declined to close at 6.25 per cent, 11.00 per cent and 13.50 per cent respectively.

Findings showed that during the period between 2010 and 2019, the average T-Bills yield was 14.7 per cent and this was, on average, 2.6 percentage points above the rate of inflation. Savers and investors had it easy during this period, as all they had to do was to invest in T-Bills in order to beat inflation.

Banks benefited from this as the primary destination of savings, as did pension funds. However, the fall in T-Bills rates in recent years, combined with a surge in the value of FGN bonds, demands a new level of risk management.

Investment risk is rising as yields fall, and fund managers and investors need to master risk management and learn the benefits of diversifying their investments across asset classes.

Today, T-Bills yield is around 8.29 per cent, and inflation rate is 28.2 per cent, which represent 19.91 per cent gap that investors have to absorb.

Hence, investors have to be a lot more subtle about what they invest in, take a degree of risk, whether that means investing in fixed income funds, credit solutions, balanced funds or equity funds.

The domestic bond secondary market also sustained bullish streak as notable demands were seen across the curve. The instruments that attracted the most buy interest and decline in yields were March-2024 (171bps) and March-2027 (69bps) at the short end and the January-2042 (117bps) and June-2038 (105bps) at the long end.

The DMO Director-General, Patience Oniha, earlier said interest on FGN Bonds is payable semi-annually; while the bullet payment is made on maturity.

She explained that the bonds qualify as securities in which trustees can invest under the Trustee Investment Act.

“They qualify as government securities within the meaning of Company Income Tax Act and Personal Income Tax Act; and for Tax Exemption for Pension Funds Administrators,” Oniha said. The FGN bonds are backed by the full faith and credit of the federal government and charged upon the general assets of the country.

Dollarisation comes with heavy risks to economy

Despite the benefits of dollar investments, the International Monetary Fund (IMF) warned that dollarising the economy could be difficult to reverse. As a partially dollarised economy, Nigerian operates with dollar bias for international trade, finance invoicing and of recent, store of value. In a report titled: “Digital Money and Central Banks Balance Sheet,” the IMF said that once a country gets used to a bi-monetary system, the process is not easy to reverse, even when the initial trigger such as high inflation, exchange rate volatility, subsides, are addressed.

“The optimal choice between domestic currency versus dollars will depend on the monetary framework and the benefits that each may offer as they co-exist as two currencies,” the IMF report added.

The IMF explained that in a highly dollarised economy, like Nigeria, there is extended use of the exchange rate for price indexation (high real dollarisation and almost complete pass-through from depreciation to inflation).

“There is limited scope for fiat currency (tax payments, public expenditure, non- durable goods, and low- value transactions). Extended forex use for durable goods, real estate, capital goods, and high- value transactions. Also, forex takes over the role of store of value as lending capacity in domestic currency becomes limited. Most loans become forex- denominated when forex bank deposits are allowed,” it stated.

But an investor’s choice of investment is determined by different factors, including if it is short or long term investment, and the returns on investment available at each point of the plan.

Overall, Obi-Chukwu advised investors to take steps to diversify their investment portfolios against inflationary risks.

He said: “There are several routes one can explore to increase wealth. Diversification of portfolios also helps to spread risks. One needs investments in bonds, fixed income, stocks, real estate, and even dollar funds. It also depends where you are in life, as investment ethos should support where you are in life, in terms of age”.

Whatever happens, investors will always go for investment that gives them the highest returns, and dollar funds seem to provide that mileage.

Be the first to comment